Annual accounting reports are crucial to a business’ success story; just ask a company such as Enron. Enron falsified their records on their annual accounting report to show more of their earnings than the losses they incurred. This scandal resulted in the downfall of Enron and is known as one of the biggest accounting scandals in history. A company’s accounting documents can be crucial to their success in the business world. These documents provide insights into their company earnings, investments, losses, and assets as a whole. This information is vital for those looking to invest through the purchase of stocks and can be a key factor in how the company will perform in later years. Creating the annual reports through the income statement, balance sheet, statements of retained earnings, and statements of cash flow are crucial in the success of a company.

What is an annual report?

An annual accounting report is a combination of the income statement, balance sheet, statement of retained earnings, and statement of cash flows. These documents provide the current year’s financial activities from the year in total, or from a specific point in time. Their main purpose is to give an overview of how efficient the business ran for that year. Some information that can be found on these statements includes net income or net loss, assets (liquid and material), and stockholder’s equity. As many accountants will explain, it is the classification of each interaction that causes the most headaches. Breaking down each exchange will help determine what portion goes on the balance sheet instead of the other three and vice versa.

The Income Statement

The income statement, in basic terms, is a quick glance of the overall gains or losses the company incurred during the entire year.

Revenue – Expenses = Net income/Net loss

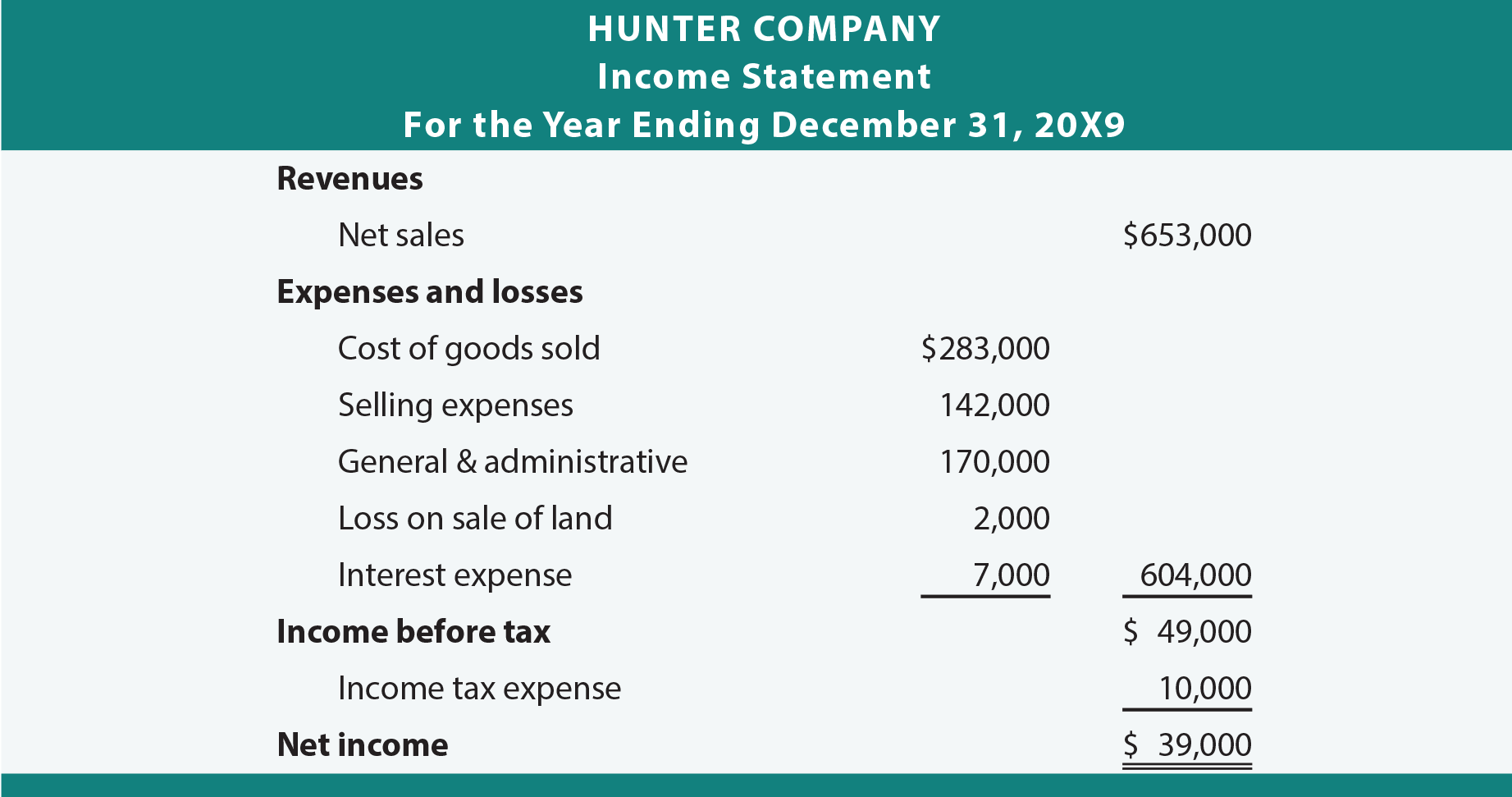

Taking this formula, revenues minus all expenses, is a general way to find net income/net loss. The determination of gain/loss is shown through the net income on the income statement. This is shown as either a positive integer, resulting in a gain, or a negative number represented as an integer in parentheses, resulting in a loss. Figure 1 shows a basic income statement that operates at a net gain. This is shown through revenues of $653,000 minus the expenses which totaled $604,000 and finally subtracting tax as well leaving Hunter Company at a net profit of $39,000.

Figure 1

The Balance Sheet

The next statement on an annual report is the balance sheet, which gives an overview of assets, liabilities, and stockholder’s equity. Unlike the income statement, the balance sheet is for an exact moment in time and not over the entire year. When breaking each section down, the formula

Assets = Liabilities + Stockholder’s Equity

allows for an accountant to double-check some of their work. Assets are any type of material that a company has value in, such as liquid cash, or the machinery they use in their day-to-day activities. Liabilities get confusing as some are close to expense accounts. Liabilities such as accounts payable and wages payable sound like expense accounts included on the income statement, but are not. Many companies do not use cash to pay off their expenses and make purchases or pay wages on account making them into a liability instead of an expense. Liabilities can be long-term or short term but are a debt owed in some way. Finally, stockholder’s equity is exactly how it sounds. This final section of the balance sheet shows the investment from the shareholder’s point of view. Stockholder’s equity includes the money reinvested back into the company, the money to pay off company liabilities, and money as dividends to the shareholders. The following video gives a basic introduction to creating a balance sheet.

The Statement of Retained Earnings

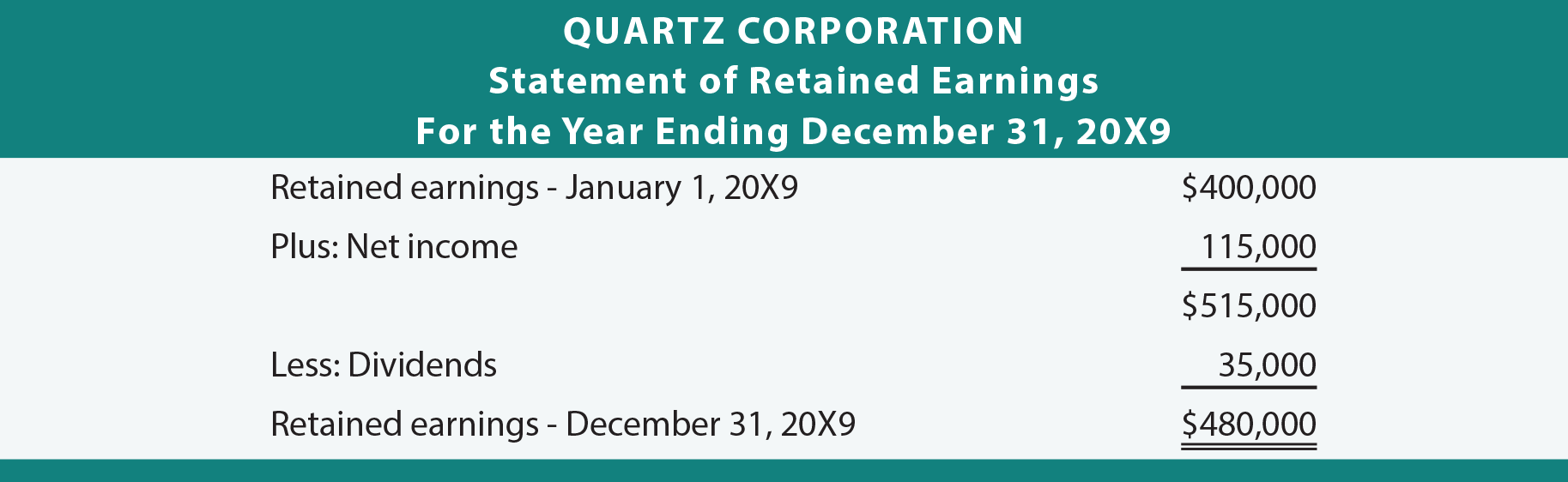

The statement of retained earnings is a combination of pieces of the income statement and the balance sheet (specific to stockholder’s equity). Since this statement is a combination of the two, it is not always shown as a separate statement. The attachment of the statement of retained earnings on the income statement or the balance sheet is common. The basic structure of the statement includes the previous year’s retained earnings, net income, dividends, and ending retained earnings. Figure 2 outlines a statement of retained earnings for Quartz Corporation for the year. Included items such as net income and dividends come from their income statement and balance sheet to give a better snapshot of the company’s overall retained earnings. This gives investors a better look into what they might get in return if they decide to invest.

Figure 2

The Statement of Cash Flows

This statement is the actual flow of cash in and out of the company. The statement of cash flows sums up nearly every transaction made by a company. This statement shows how well a company brings in the necessary funds to pay off their liabilities each year and manage their overall expenses. This information gives investors a viewpoint of how well the company manages its finances. If the company spends more many than they make year after year, it could show as a red flag for an aspiring investor. The following video featuring CEO of Rule #1 Investing, Phil Town, breaks down the importance of the statement of cash flows as well as how to read it.

As a whole, all four of the statements hold benefit for investors but are also crucial to the company as well. These statements allow the company to reflect on how the year went and what they need to change for the years to come. GAAP (Generally Accepted Accounting Principles), requires that all companies prepare each statement for every year-end. As stated previously, the statement of retained earnings attached to the income statement or balance sheet would result in only three statements, while still in conformance with GAAP. From a business standpoint, each statement is crucial to show the effectiveness of the company and to show potential investors the correct place to spend their money.